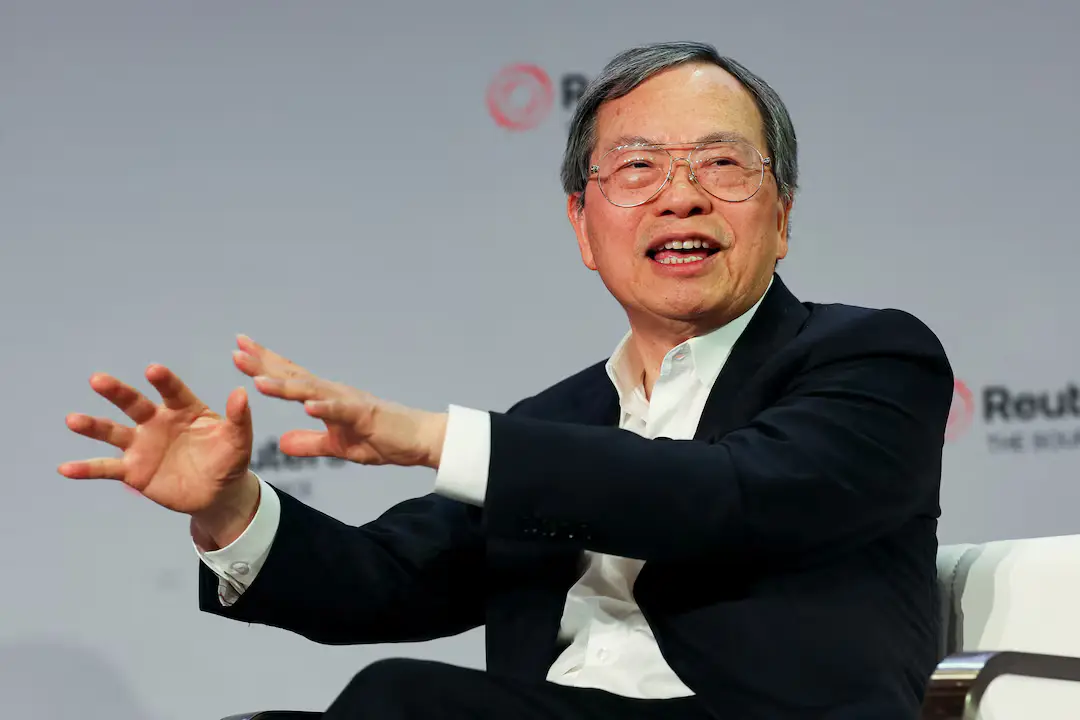

Super Micro Computer is the global leader in providing high-performance computing solutions and has been coming under increasing pressure related to its listing status on stocks. Even with the concern raised regarding listing requirements, in recent times, there was still optimism from Chief Executive Officer Charles Liang about being delisted.

A lot has been said about Super Micro in recent times due to the server solutions and advanced technologies, but it was a long time coming since they hit some financial problems and the late submission of their financial statements, hence raising questions about whether it could stay on the Nasdaq stock exchange since only a few companies have remained after failing to meet financial reporting and governance requirements.

The company had been issued a warning by Nasdaq earlier because it failed to file its annual report for the previous fiscal year. Nasdaq has a rule whereby companies are expected to submit their financial filings within a stipulated time, and in case they fail to comply, it might lead to delisting. However, Super Micro has made all efforts to rectify the matter and has recently filed a plan with Nasdaq about how to correct the issue.

Super Micro’s optimism arrives at a time when its outlook on the financial front is also starting to brighten. The company has reported considerable growth in most of its core business lines, especially in the areas of data centers and cloud computing. Even though the delay in filing the report had a negative impact, Super Micro still continues to enjoy strong demand for its products, especially as more businesses and organizations upgrade their IT infrastructure to meet the growing demands for cloud services.

Super Micro’s recovery plan lies in improving its internal financial reporting systems so that it can ensure it stays in line with all the regulations that will be applicable in the future. The company has already brought about changes in its accounting processes to streamline them and, therefore, increase transparency towards investors. Moreover, Super Micro is finalizing audits so that it brings the financial filings up to date.

As Super Micro moves to correct its financial reporting problems, it is confident that such efforts will prevent delisting. The leadership of the company is focused on ensuring that their stock remains a viable investment and that shareholders see value in the long run.