Stocks for several prominent companies in the area of quantum computing took a beating after comments made by Nvidia CEO Jensen Huang in regards to how long it may take for actual quantum computers. Speaking recently, Huang indicated that practical, useful quantum computing remains decades away. His comments combined with the debate in the technology community caused Rigetti, IonQ, and D-Wave Quantum stocks to decline sharply.

Huang, a figurehead of the tech world mainly due to Nvidia’s pivotal role in AI advancement, acknowledged, “Quantum computing has huge promise, but it’s still extremely far away from being a mainstream technology.” He doubted that the technology was ready for large-scale commercial use and said that “very simple quantum computers” could be 15 to 30 years away. This projection comes as a reality check for investors and enthusiasts who have hoped for quicker breakthroughs in quantum technologies.

This timeline by Huang is a contrast to the overly optimistic expectations that have been prevalent in the tech industry. Companies in the quantum computing space had built up a lot of anticipation for breakthroughs in the near term and were claiming that quantum computers would change everything from cryptography to medicine to material science. But Huang’s comments bring a measure of clarity to the speculative market, discussing the large technical hurdles remaining before quantum computing can be broadly applied.

The reaction in the stock market was quick. Shares of quantum computing companies like IonQ and D-wave Quantum, which had seen massive gains in the past year, plunged as investors reacted to the sobering outlook. D-Wave Quantum saw its stock price plummet significantly, with many analysts attributing this to the recalibration of the market after Huang’s comments.

This has been a particularly tough blow for companies like Rigetti Computing, which continues to struggle to develop commercially viable quantum computing products.

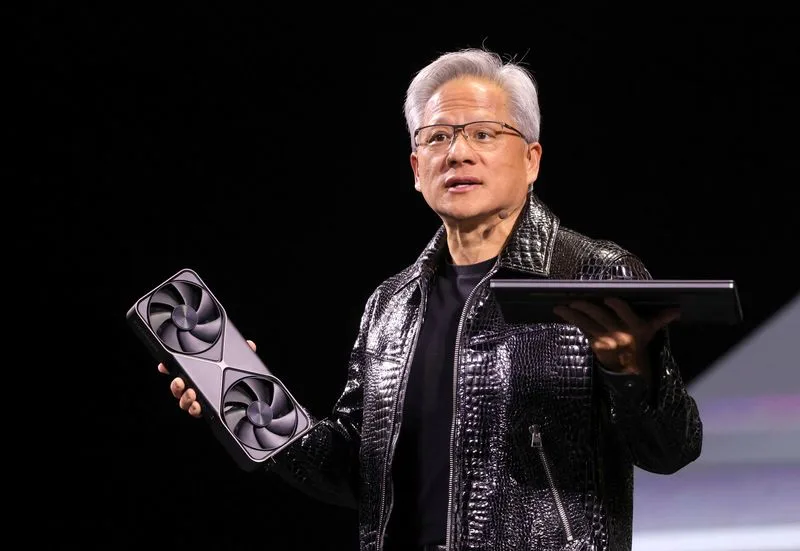

While Huang did mention the long-term potential of quantum computing, he did say that the industry must focus on the intermediate technologies, often called “pre-quantum” systems, to bridge the gap to full-fledged quantum machines. Nvidia has been making progress in these areas with its powerful GPUs and AI-focused hardware, positioning the company well for the computational needs of the future, even if those needs are currently far removed from true quantum capabilities.

Huang’s words are based on the fact that quantum physics deals with huge difficulties: quantum coherence and error correction, among others that are required for proper functioning systems of quantum computation.

Such requirements have led many people to believe that even though there is much promise from quantum computing, it will not be ready for massive applications for many years. Huang’s statements appeared to indicate the focus will likely remain on the classical computing system for the future, which in itself is in rapid evolution as it continues, particularly in the two areas of interest: artificial intelligence and machine learning.

Despite the pessimism surrounding the near-term future of quantum computing, the industry still draws a lot of investment. But now, the market is taking a new review of what is realistically achievable in the near term. Huang’s message is a reminder that all inventions cannot be rushed, and the hype over quantum computing may need to be brought down to earth by some fuller understanding of how the technology really works.

For Nvidia, Huang’s remarks provide an opportunity to further solidify its position as a leader in the AI and computational hardware space. As quantum computing remains a long-term vision, Nvidia continues to benefit from its dominance in the AI market, where demand for advanced GPUs is surging. The company’s leadership in AI technologies could make it a major player in whatever future quantum computing systems emerge, providing a bridge between current technologies and those of the distant future.

The immediate effects on the stock market have underlined how volatile tech stocks can be, especially when a leading figure like Huang provides a frank assessment of emerging technologies. While quantum computing stocks have taken a hit, Nvidia’s own stock has largely remained unaffected by Huang’s comments, a reflection of its more immediate market dominance and stability. The tech world will be watching closely to see how quantum computing evolves in the years to come, but for now, the industry may need to recalibrate its expectations.

In conclusion, the timeline for quantum computing remains uncertain, with practical applications still far off. Huang’s comments underscore the fact that while the potential for quantum technology is undeniable, the journey to fully functional quantum computers may take decades. For now, the industry must continue to work on incremental advancements, while investors and companies adjust their strategies to align with the slow but steady progress in this nascent field.